modified business tax nevada due date

This 150 is due regardless of income or business activity. Arkansas LLCs must file Annual Franchise Tax Reports.

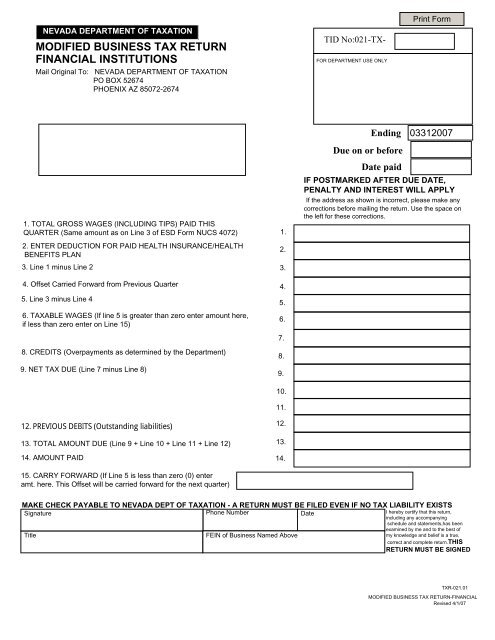

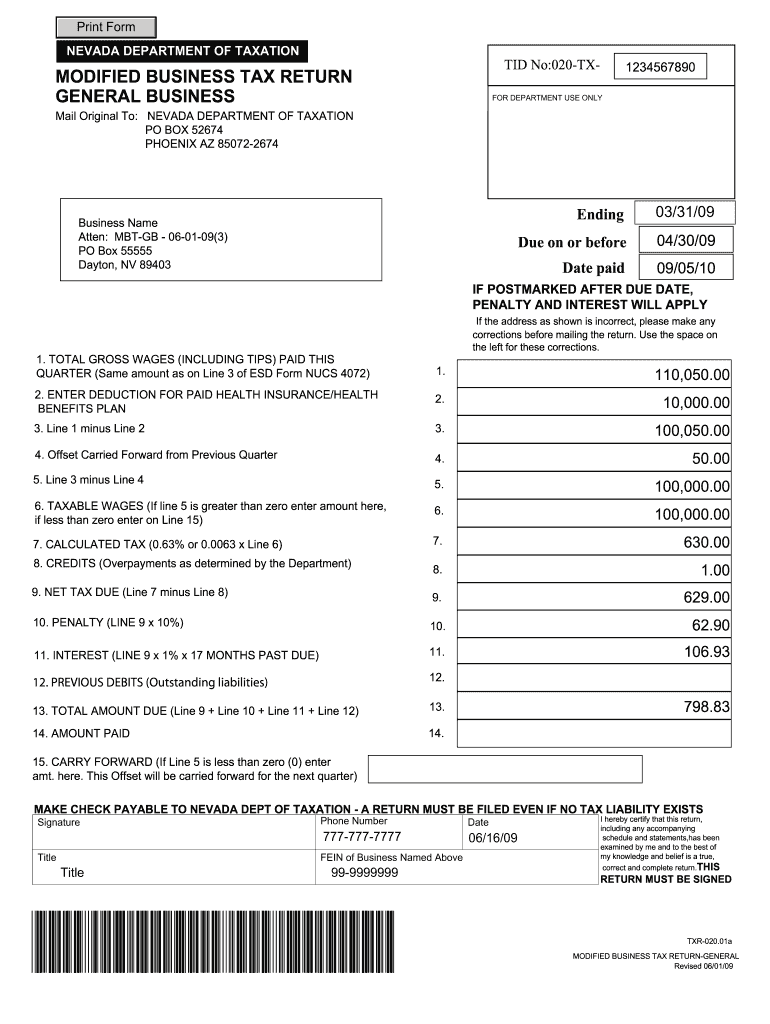

The return will calculate penalty and interest based on the Date Paid field.

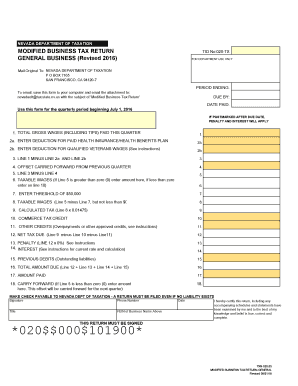

. The Annual Franchise Tax Report must be filed every year in order to keep. For returns filed and paid within 30 days of the due date the penalty calculation is a graduated scale per NAC 360395. The correct tax rates will display based on the period end date selected.

Instructions are included following the return. As per Section 26-54-104 of the Arkansas Corporate Franchise Tax Act all Arkansas LLCs are required to file an Annual Franchise Tax Report along with a flat-rate tax of 150.

Modified Business Tax Return Financial Institutions

Nevada Commerce Tax What You Need To Know Sage International Inc

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

State Of Nevada Department Of Taxation Ppt Video Online Download

How To File And Pay Sales Tax In Nevada Taxvalet

2022 Federal Tax Deadlines For Your Small Business

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Taxes 2020 Everything You Need To Know About Filing This Year Cnn Business

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

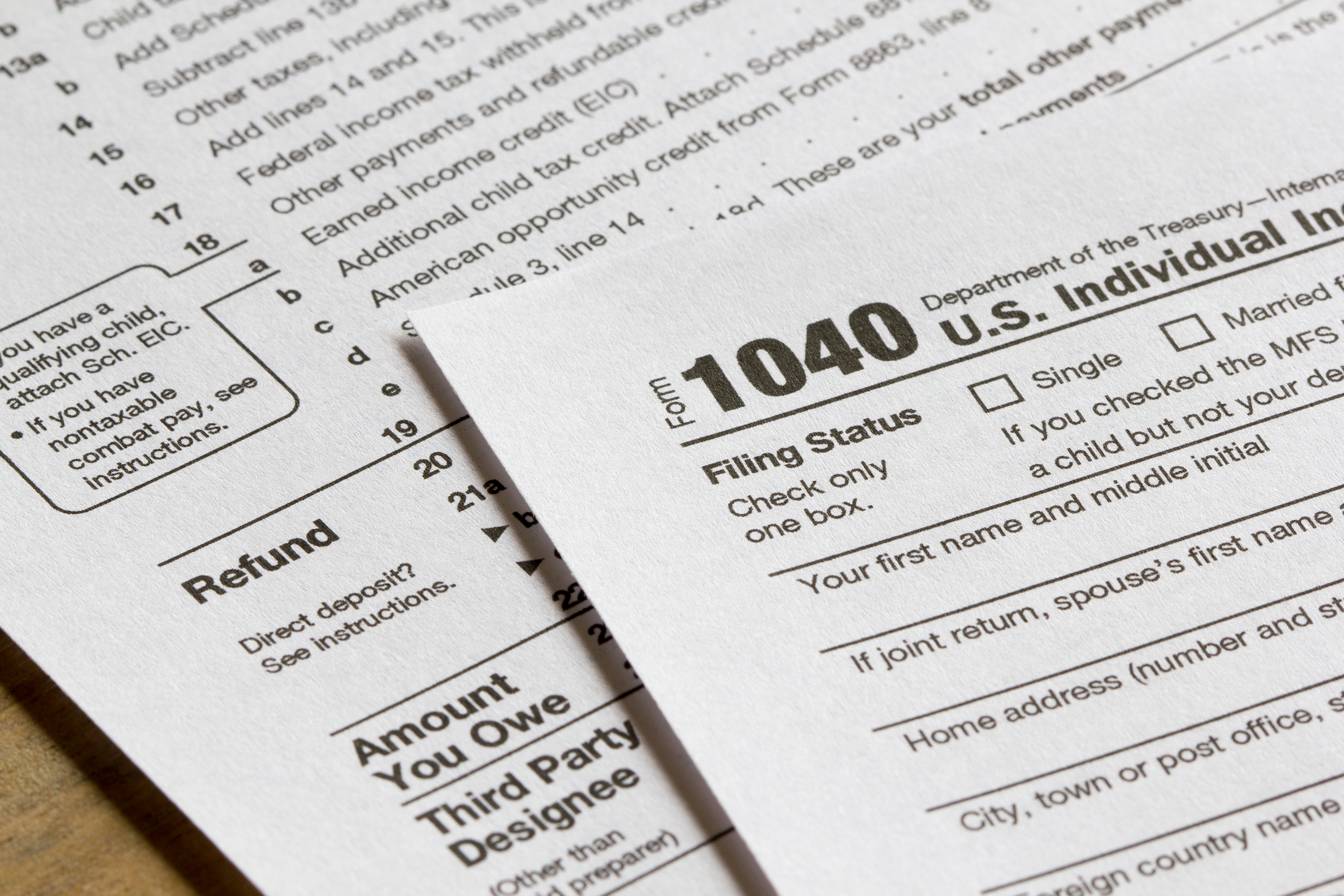

Corporate Tax Return Due Date 2019

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms